The move to e‑Invoicing in Malaysia (via MyInvois by LHDN) changes how travel agencies issue, store, and share invoices, credit notes, and receipts. This guide explains what changes, common travel scenarios, and how WauHub helps you stay compliant without slowing down sales.

Why e‑Invoicing matters for travel agency

Travel sales often involve deposits, balance payments, supplier commissions, multi‑currency, and last‑minute changes. e‑Invoicing brings structure to these flows so that what you charge, what you collect, and what you report to LHDN are always aligned.

- Better cash flow tracking across deposits and balances

- Cleaner audit trail for refunds, add‑ons, and date changes

- Less manual re‑keying between systems and Excel files

- More professional experience for customers and corporate buyers

What changes with MyInvois

At a high level, e‑Invoicing means:

- Each sale needs a compliant e‑Invoice payload submitted to LHDN’s platform

- Adjustments use e‑Credit Notes or e‑Debit Notes linked to the original invoice

- Buyer details matter more (e.g., TIN when relevant), especially for B2B

- You keep the customer experience simple while the system handles compliance

Note: Specific obligations depend on your business profile and transaction type (B2B, B2C, B2G). Always consult your tax advisor for your exact scenario.

Common travel scenarios and how to handle them

1) Deposits and balance payments

- Issue an e‑Invoice for the deposit when collected

- Issue a second e‑Invoice for the balance when due

- Reference the booking/order for continuity and clean reporting

2) Package changes and add‑ons

- Increase: issue an e‑Debit Note referencing the original e‑Invoice

- Decrease/cancellation: issue an e‑Credit Note referencing the original e‑Invoice

3) Agent vs. principal model

- If you sell as principal, invoice the customer for the full amount and expense suppliers separately

- If you sell as agent on commission, invoice only for your fee/commission where appropriate

4) International customers and multi‑currency

- Keep the transactional currency and provide the MYR equivalent in reporting where required

- Capture buyer details consistently even if the traveler is foreign

How WauHub helps you comply (without hassle)

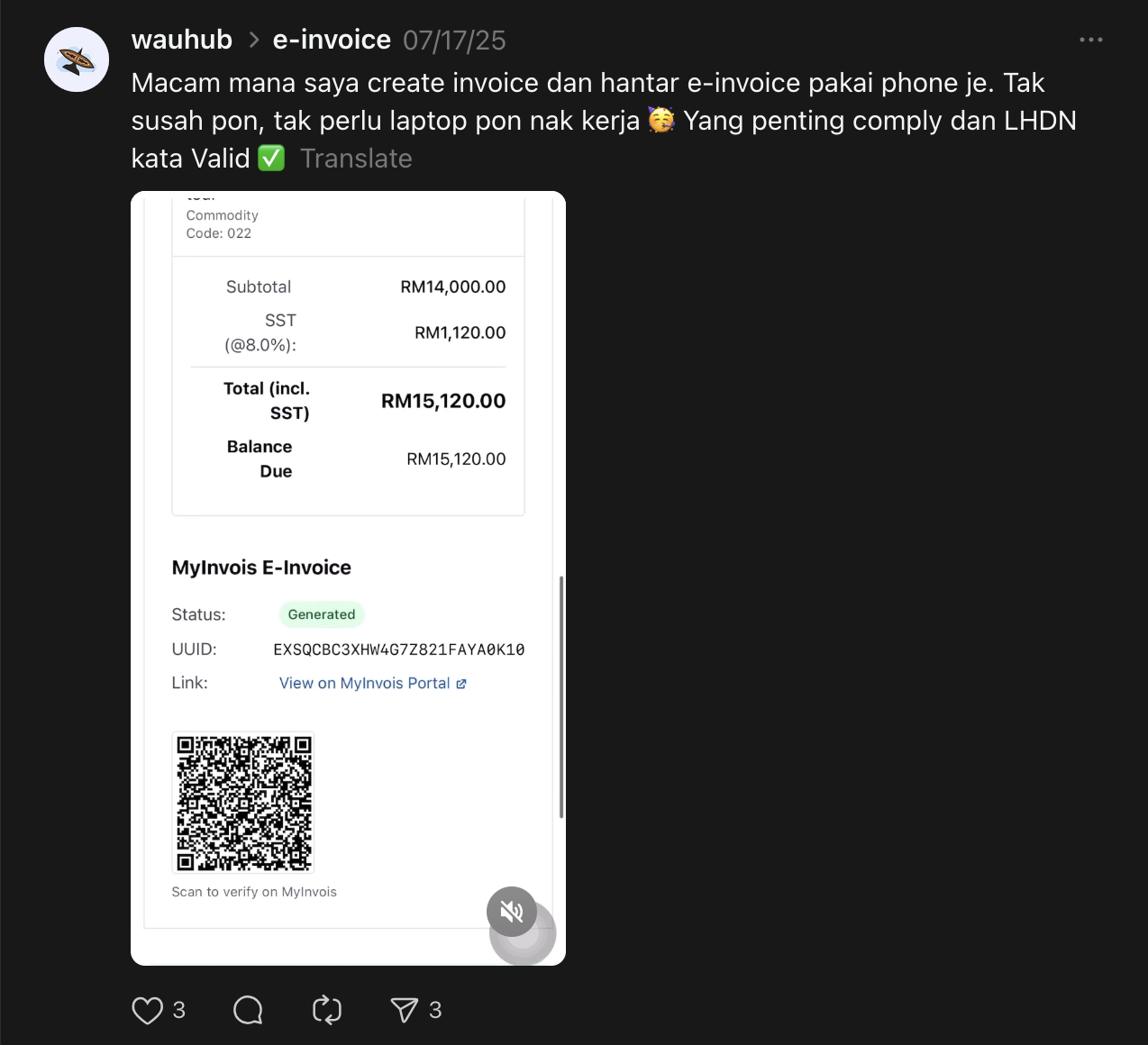

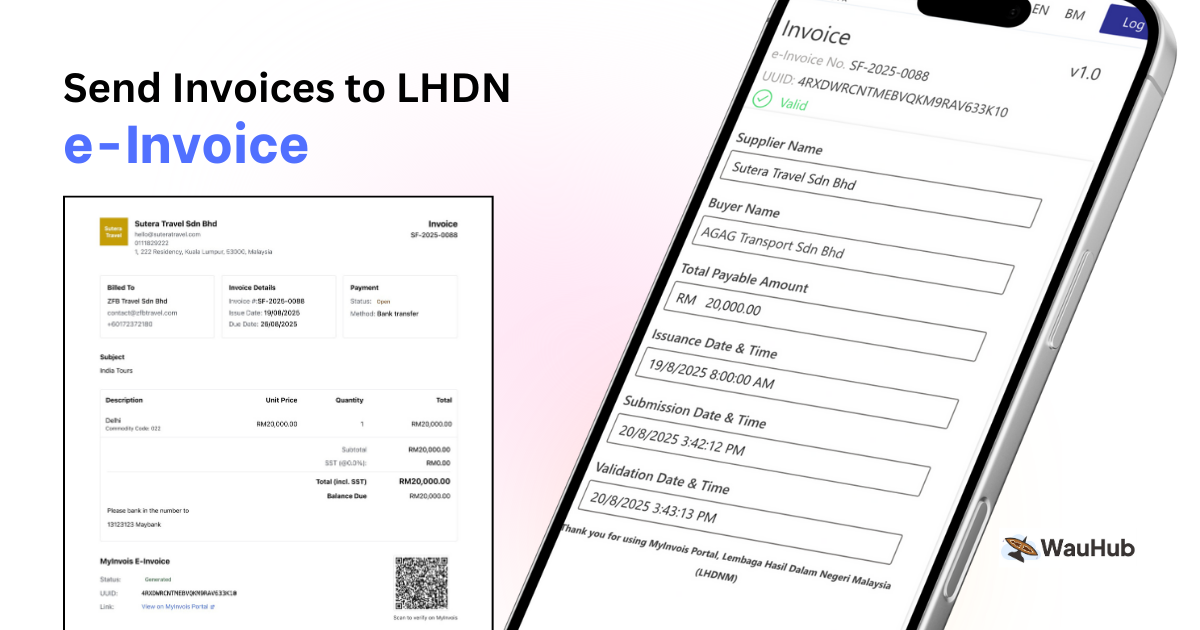

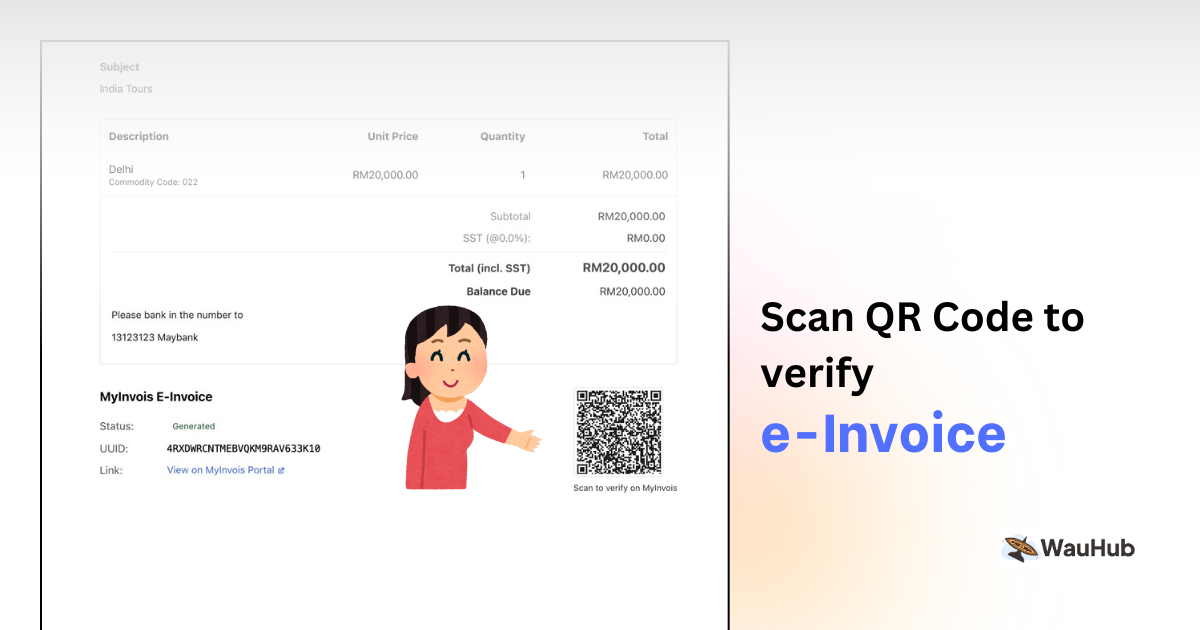

WauHub is built for Malaysian travel workflows and e‑Invoicing:

- Malaysian‑ready templates with SST fields and local formatting

- MyInvois‑ready data model mapped to required fields

- Built‑in validations to catch missing buyer info and totals mismatches

- Optional TIN lookup and taxpayer checks before issuing B2B e‑Invoices

- One‑click sharing via link/WhatsApp and payment collection (FPX, cards, QR)

- Automatic document trail: invoice → payment → credit/debit notes

See our live demo here at threads https://www.threads.com/@wauhub/post/DMMMhfCzAeB

Step‑by‑step setup in WauHub

- Add your business profile: legal name, registration, SST settings

- Create products: tours, add‑ons, fees (include tax applicability)

- Verify buyer info for B2B (name, TIN when relevant)

- Issue invoice for deposit; send secure link for payment

- Add balance invoice on confirmation; auto‑reconcile payments

- If plans change, create e‑Credit/Debit Notes referencing the original

- Keep everything synced for clean reporting and audit trail

Tips to stay out of trouble

- Be consistent with booking IDs across invoices and notes

- Avoid free‑text taxes; use configured SST settings

- Separate your role (principal vs. agent) per product to avoid confusion

- Use templates for common tour types to reduce mistakes

- Keep customer communication simple; let the system handle compliance

FAQ

Do I need e‑Invoice for walk‑in/consumer sales?

It depends on the latest LHDN rules for your profile and thresholds. Many agencies issue compliant documents for all sales to keep records consistent. Check with your tax advisor.

What about refunds?

Use an e‑Credit Note linked to the original e‑Invoice; keep the reason clear (cancellation, price adjustment, overpayment).

Can I collect a deposit first?

Yes. Issue an invoice for the deposit when you collect it, then another invoice for the remaining balance.

Ready to simplify e‑Invoicing and bookings? Contact us and we’ll walk you through a setup tailored to your travel business.