LHDN e‑Invoice Guide

This simplified guide (distilled from 450 pages of official documentation) walks you through creating and submitting a compliant e-Invoice in LHDN’s official MyInvois portal, with clear, screenshot-based steps.

You’ll log in, create a new document, enter invoice details, add seller and buyer information, capture line items with correct categories, review everything, then sign and submit. We also show how to confirm submission status and customer verification.

Let's dive into the steps!

Step-by-step how to create an e‑Invoice

Follow these steps inside the MyInvois portal to issue an e‑Invoice.

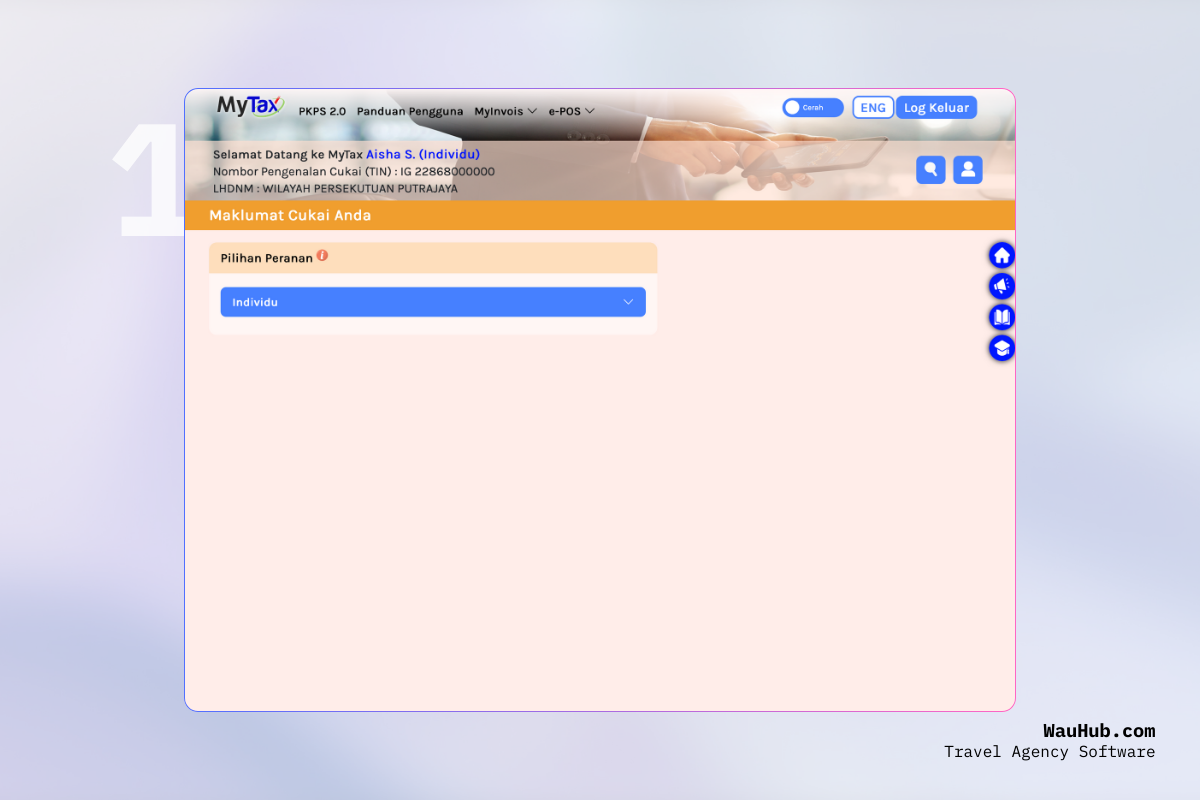

1. Log in to MyInvois

Go to the MyInvois portal and sign in using your registered credentials. https://mytax.hasil.gov.my

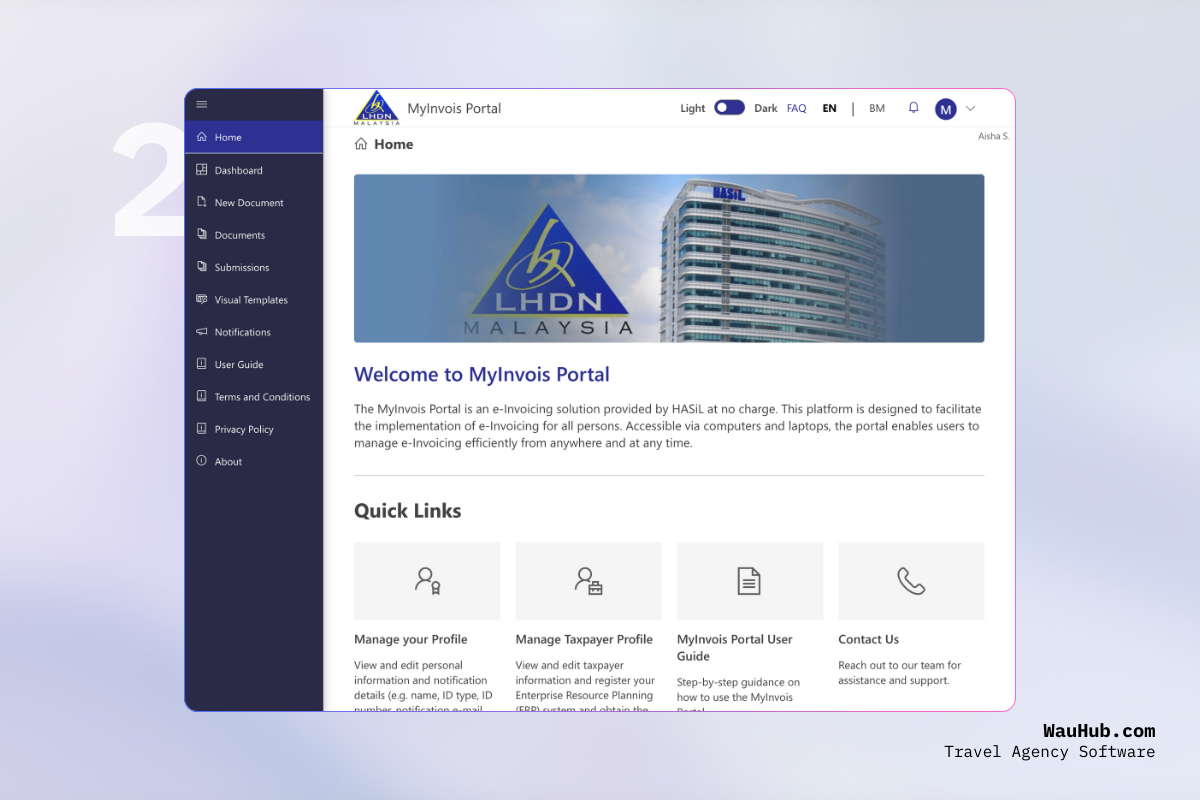

2. Access the Dashboard

After login, you’ll see the MyInvois dashboard with your recent documents and actions.

Click New Document to create a new e‑Invoice.

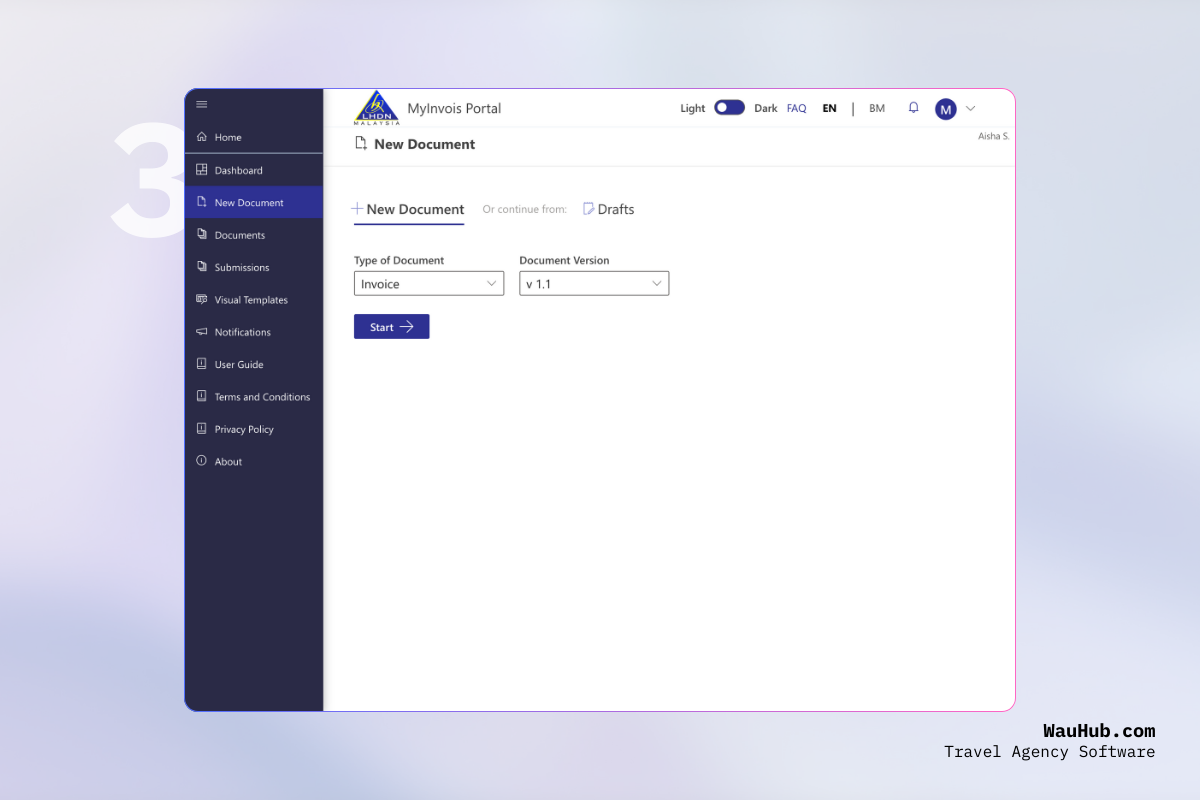

3. Create a New Document

Click New Document and select the correct e‑Invoice UBL version as required. V 1.1

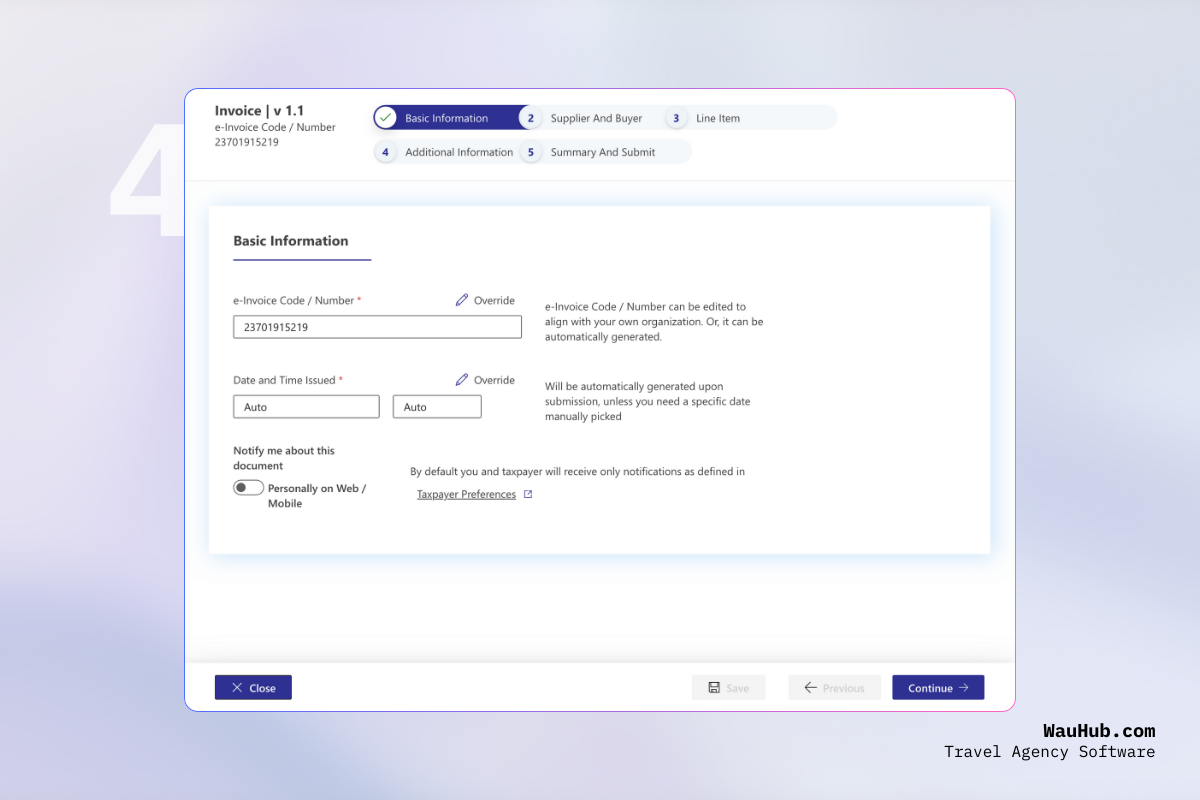

4. Fill in Invoice Information

Enter invoice date and time.

5. Add Seller and Buyer Details

Provide accurate seller (your business) and buyer information. IMPORTANT: Verify TIN/BRN. You need to get TIN/BRN, IC (individual) from your customer.

%20and%20Buyer%20(Customer).png)

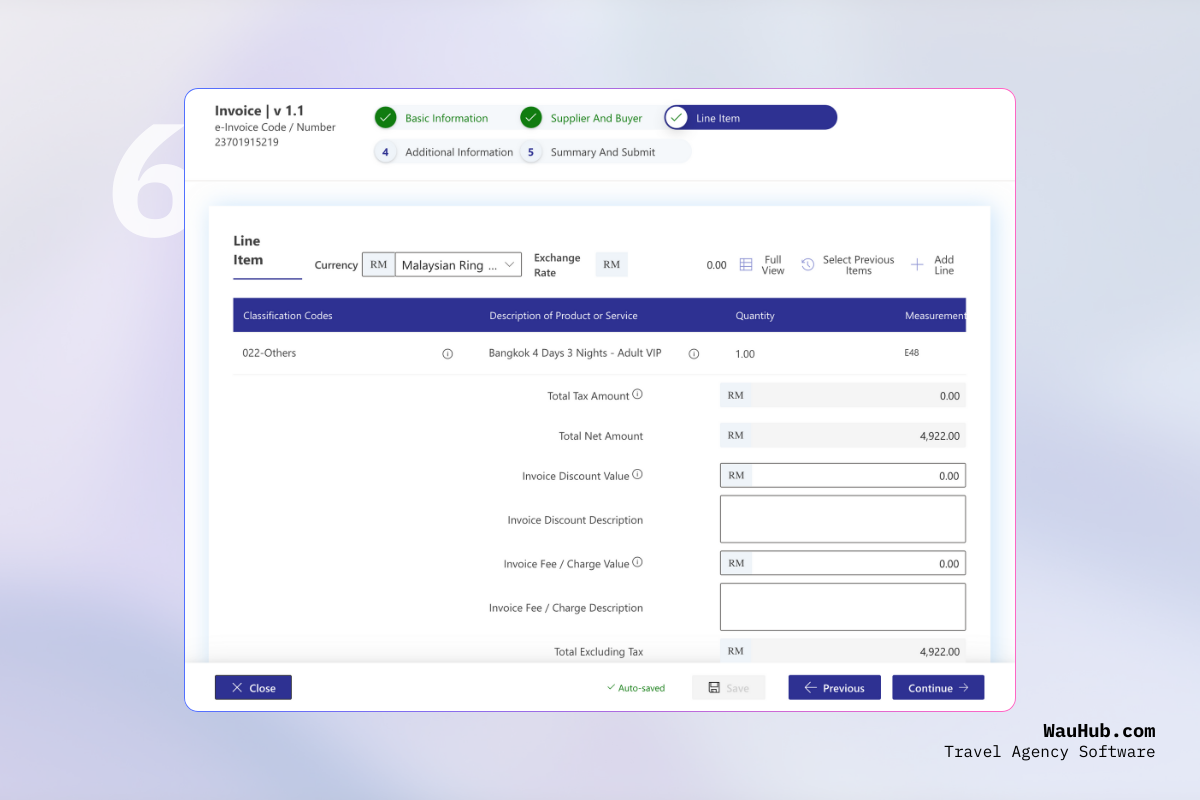

6. Add Line Items

Enter item name, quantity, unit price, and applicable taxes/discounts.

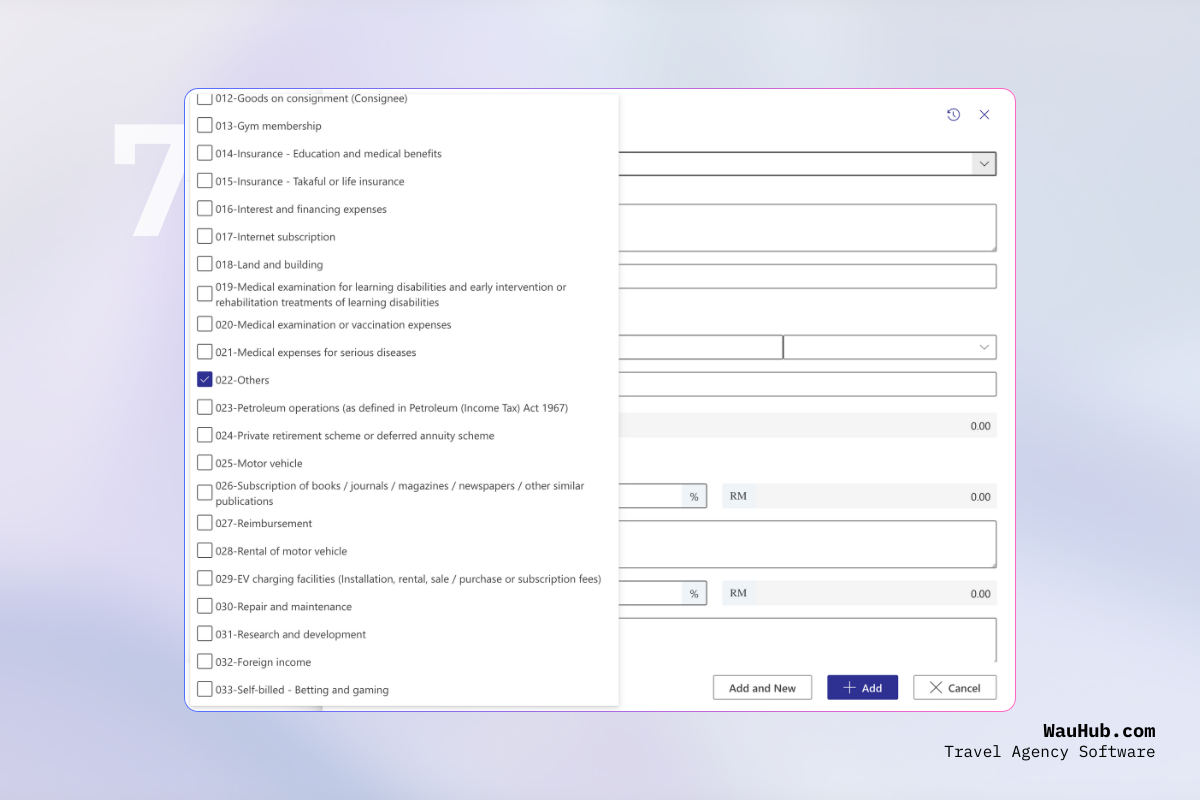

7. Choose the Item Category

Select the correct item category according to MyInvois rules to ensure compliance. Usually 022.

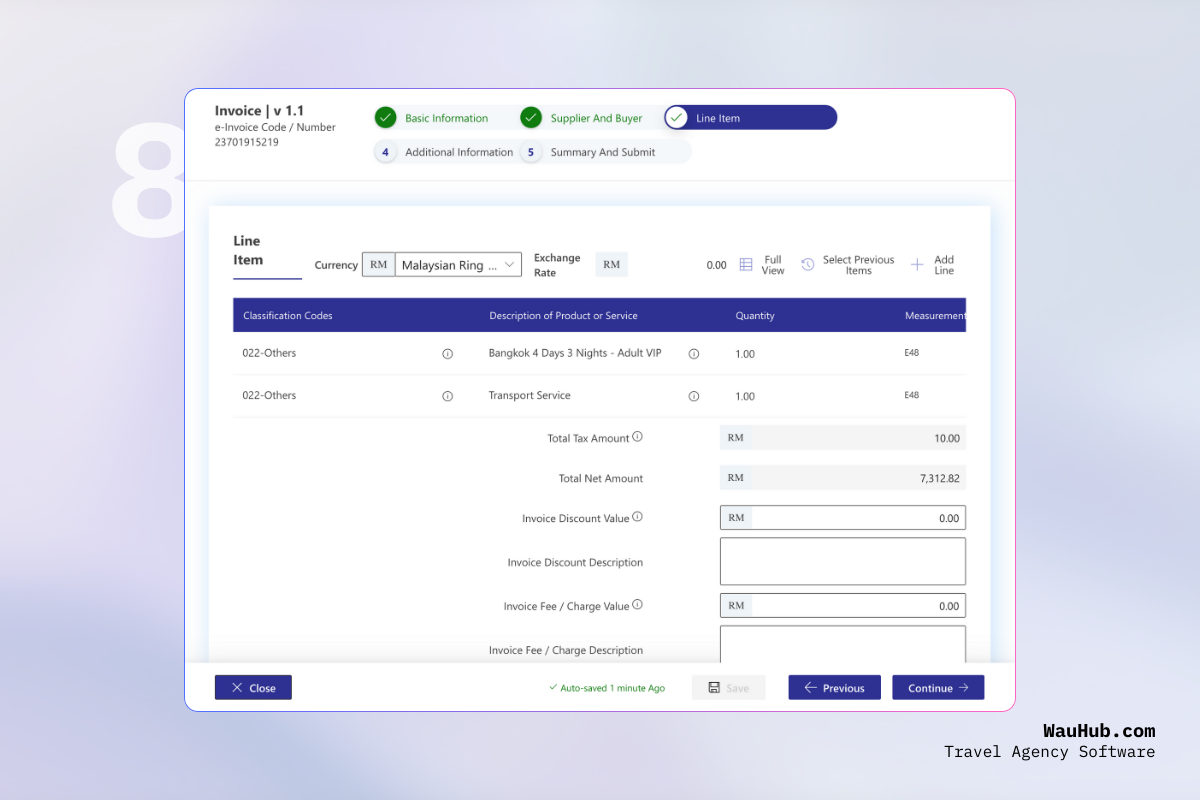

8. Finalize Line Items

Confirm totals, taxes, and any discounts are correct.

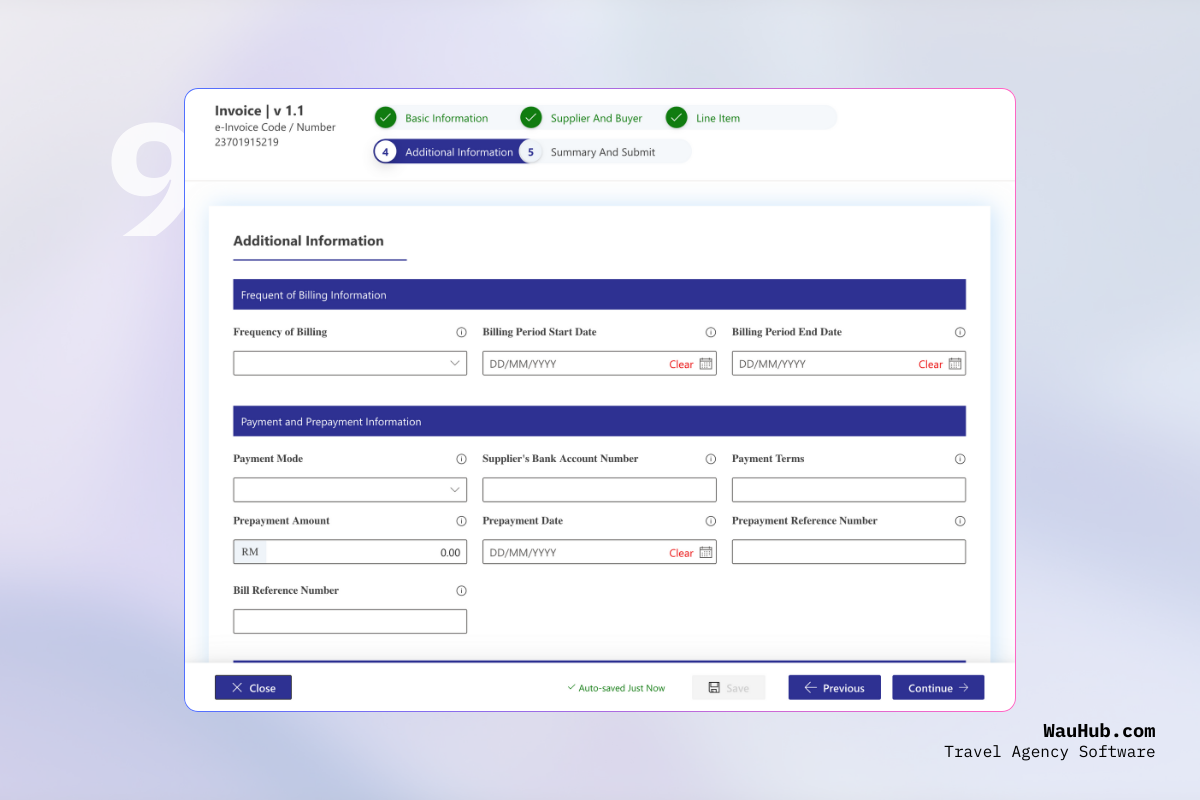

9. Billing and Payment Info

Provide payment terms and billing references if needed. Skip this step if not required.

10. Review Buyer & Seller Details

Review the summary screen carefully to ensure all parties’ information is correct.

.png)

11. Review Items Summary

Confirm all line items, taxes, and totals are accurate before submission.

.png)

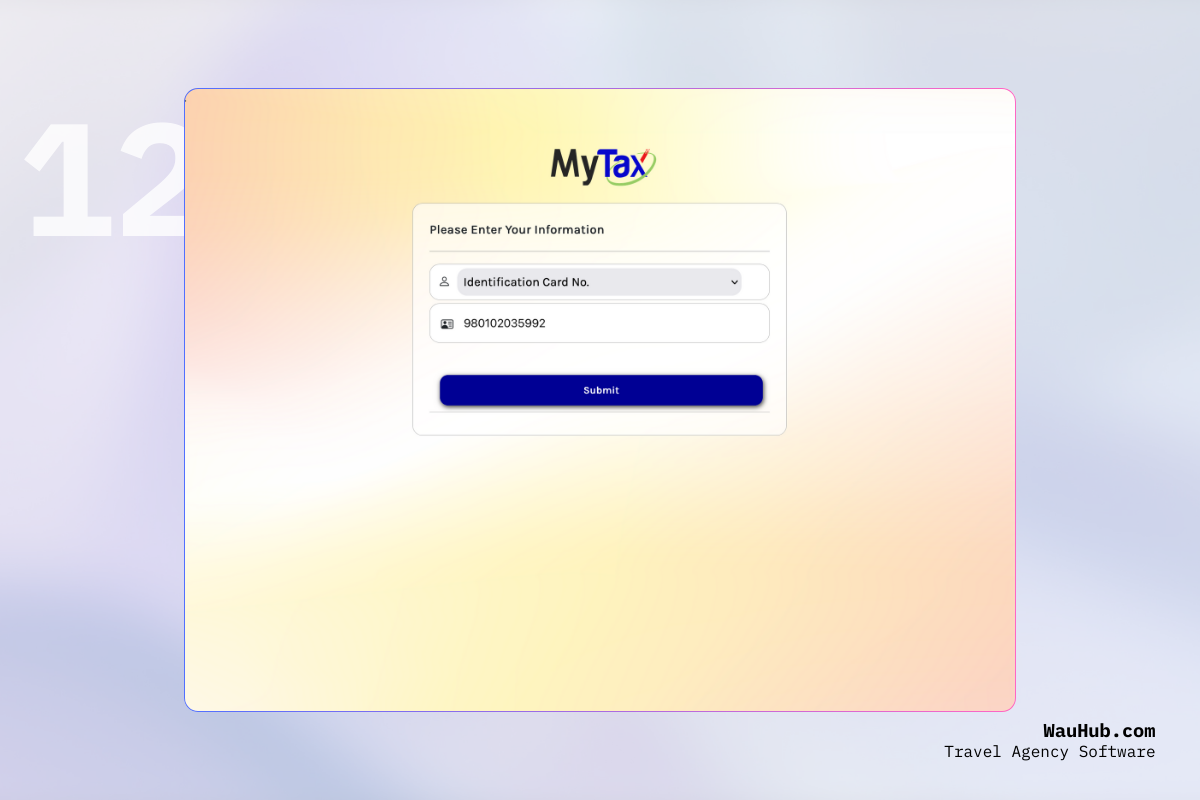

12. Sign In to Submit

If prompted, re‑authenticate to sign and submit the e‑Invoice.

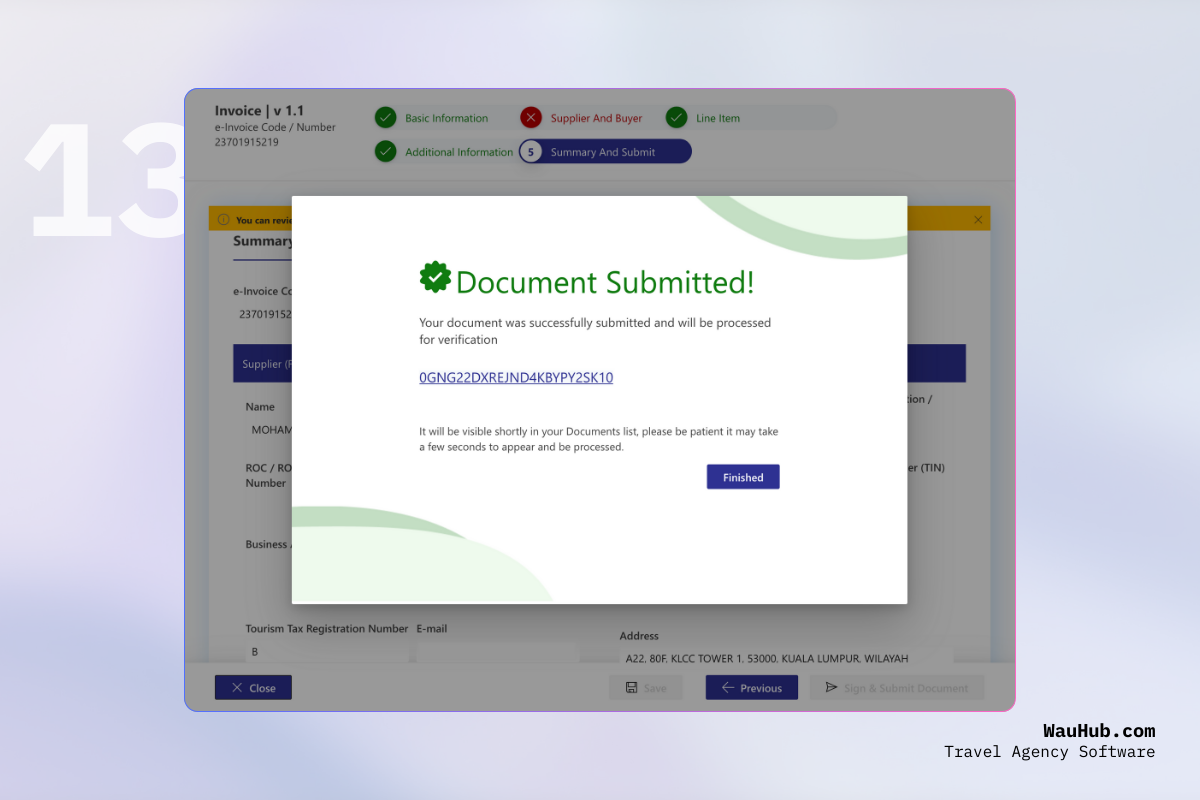

13. Submission Status

After submission, the document is sent to LHDN. You will see the status and QR once accepted.

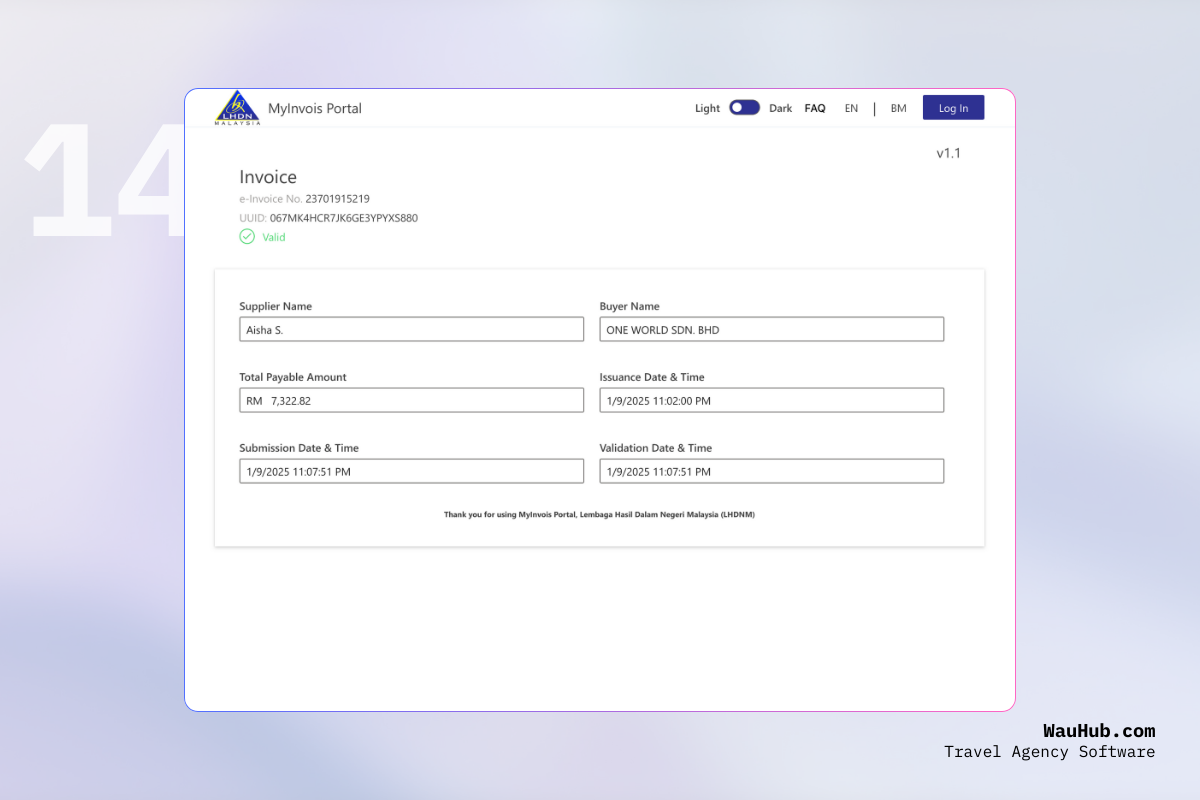

14. Customer Verification

Customers can verify the e‑Invoice using the QR or verification page.

Congratulations! You’ve Issued Your First e‑Invoice!

E‑Invoicing itself isn’t hard! The portal’s user experience makes it feel hard. It adds friction for sales and accounting teams because issuing a single e‑Invoice means navigating several screens and keying in dozens of fields.

As the platform is still new and sometimes buggy, the process can feel slow. If you need to submit 20–50 invoices in a single day (for example, during MATTA Fair), the time cost compounds and slows your team down.

Why WauHub Solves These Problems

We remove the friction of manual portal entry by streamlining e‑Invoice creation into a single, guided flow. Smart defaults, reusable buyers and items, automatic tax treatment, and prefilled seller details cut out repeat typing and reduce mistakes.

Built‑in validation checks against MyInvois rules before submission, so you catch issues like missing identifiers, wrong categories, or totals mismatches early, not after the portal rejects the document. Credit/debit notes and cancellations follow the same guided logic to stay compliant.

WauHub is designed for speed at scale: templates, catalogued line items, fast entry, and customer autofill make issuing dozens of invoices fast. For peak periods such as MATTA Fair, bulk actions and integrations help your team keep moving without bottlenecks. Focus on your sales, submit e-Invoice later.

End‑to‑end invoicing is built in: send payment links (FPX, cards, DuitNow QR), track live status with QR, auto‑generate receipts, and trigger reminders. Your team sees where every invoice stands (draft to paid) without jumping between tools.

The result: fewer errors, faster cash collection, and consistent MyInvois compliance, while giving your sales and finance teams back hours every week.

Read our blog post on https://wauhub.com/2025/08/30/my-invois-e-invoicing-guide-for-travel-agencies for more details.

Tips

- Keep buyer details (TIN/BRN) up to date to reduce rejections.

- Use accurate categories for each line item to meet validation rules.

- Double‑check date/time and currency before submitting.

- Save the acknowledgement and QR for your records.

Ready to Transform Your Travel Agency?

Get your whole team working in one place. Stop copying data between spreadsheets. Start saving time and selling more trips.