Most businesses will panic when LHDN knocks on their door. But by then, it’s too late. The e-Invoice deadline is 1 January 2026, and if your travel agency isn’t ready, you won’t be able to issue valid invoices to your customers. Corporate clients will reject non-compliant invoices. Your cash flow stops. Don’t wait for the knock.

Key Information

| Detail | Information |

|---|---|

| Deadline | 1 January 2026 |

| Days Remaining | 24 days (as of 7 December 2025) |

| Who Must Comply | Businesses with annual revenue ≥ RM1,000,000 |

| Regulatory Body | LHDN (Lembaga Hasil Dalam Negeri) |

| System | MyInvois Portal |

What This Means for Travel Agencies

If your travel agency generates RM1 million or more in annual revenue, you are required to issue e-Invoices through LHDN’s MyInvois system starting 1 January 2026.

This is not optional. Non-compliant invoices may not be accepted by corporate clients and could result in penalties from LHDN.

Understanding E-Invoice

E-Invoice is not simply sending invoices via email. It’s a structured digital document that must be validated by LHDN before it becomes legally valid.

The Process:

- Create invoice in compliant system

- System submits to MyInvois API

- LHDN validates and returns unique identifier + QR code

- Invoice is now legally valid

- Customer receives verified document

Without LHDN validation, the invoice is not considered valid for tax purposes.

Requirements Checklist

Before you can issue e-Invoices, ensure you have:

- Tax Identification Number (TIN) - Verify at mytax.hasil.gov.my

- Business Registration (SSM)

- SST Registration (if applicable)

- MyInvois-compliant software or portal access

- Digital certificate for API authentication

Travel Agency Specific Considerations

Travel businesses have unique invoicing requirements that generic accounting software may not handle well:

| Scenario | E-Invoice Requirement |

|---|---|

| Deposit collection | Issue e-Invoice for deposit amount |

| Balance payment | Issue separate e-Invoice for balance |

| Package changes | Issue e-Debit Note (increase) or e-Credit Note (decrease) |

| Refunds | Issue e-Credit Note linked to original invoice |

| Foreign customers | Use general identifier for B2C transactions |

Your Options

Option 1: MyInvois Portal (Manual)

- Cost: Free

- Best for: Low volume (1-5 invoices/day)

- Limitation: Manual entry, no automation

Option 2: General Accounting Software

- Cost: Varies

- Best for: Standard business invoicing

- Limitation: May not support travel-specific workflows

Option 3: Travel-Specific Software

- Cost: Subscription-based

- Best for: Travel agencies with deposits, bookings, multi-currency

- Advantage: Built for travel workflows, automatic compliance

24-Day Implementation Timeline

Week 1 (7-13 Dec): Preparation

- Verify TIN and business registration

- Choose your e-Invoice solution

- Sign up and configure business profile

Week 2 (14-20 Dec): Setup

- Import customer database

- Configure products and pricing

- Set up SST settings

- Create invoice templates

Week 3 (21-27 Dec): Testing

- Issue test invoices

- Train staff on new workflow

- Resolve any issues

Week 4 (28-31 Dec): Go Live

- Begin issuing real e-Invoices

- Monitor submission status

- Ensure all invoices are validated

Common Questions

Q: What if my revenue is below RM1 million? A: You are not required to comply in this phase, but voluntary adoption is encouraged. Future phases will lower the threshold.

Q: Can I still issue paper invoices? A: You can provide paper copies to customers, but the e-Invoice must be submitted to MyInvois first.

Q: What happens if I miss the deadline? A: Invoices issued without MyInvois validation may not be accepted by corporate clients and could result in compliance issues with LHDN.

Q: How long does setup take? A: Most agencies can be fully operational within 1-2 weeks with proper preparation.

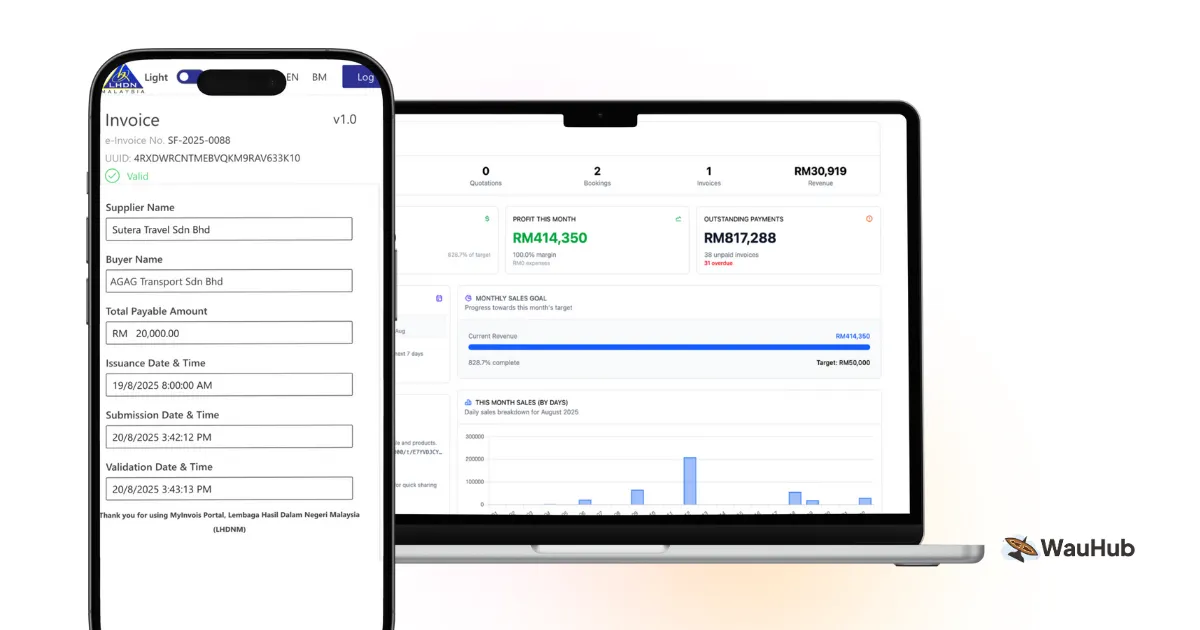

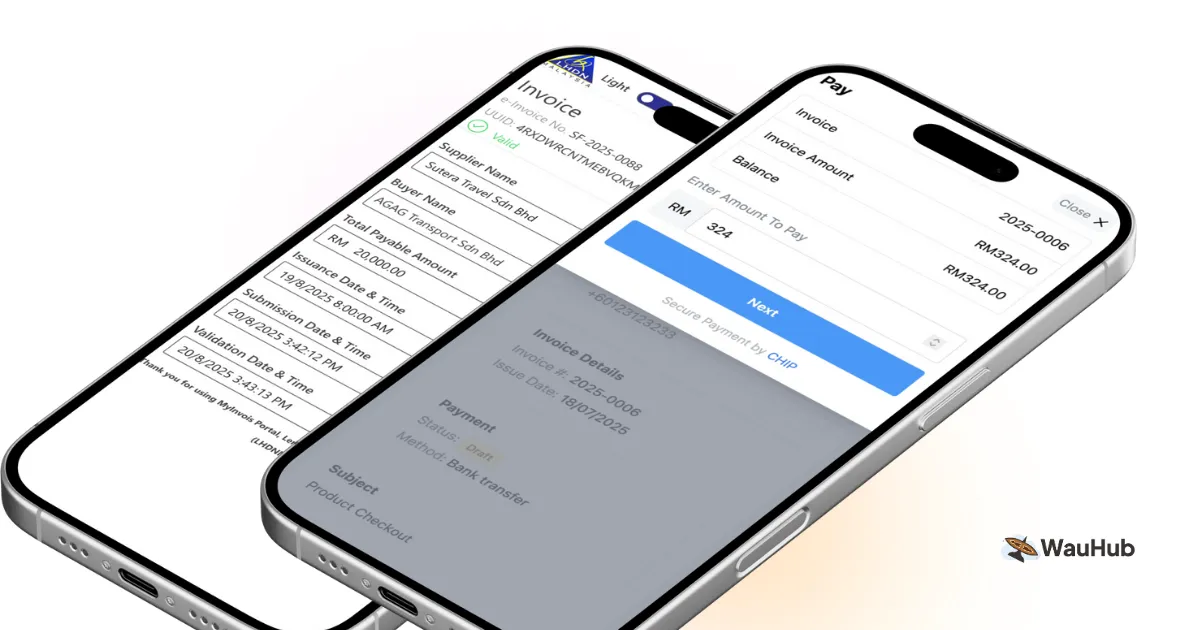

WauHub E-Invoice Features

WauHub provides full MyInvois integration designed for Malaysian travel agencies:

- One-click submission to MyInvois

- Automatic QR code generation

- SST calculation built-in

- Credit/Debit notes linked to original invoices

- Deposit & balance workflow support

- Real-time status tracking

Don’t wait until 31 December. Start your setup today.