e-Invoice for Malaysian

Travel Agencies

Create your invoice, click submit, done. WauHub sends it to LHDN MyInvois and you get a QR code your customer can scan to verify. No more manual uploads or complicated forms.

What is LHDN e-Invoice?

LHDN now requires all businesses to submit invoices electronically. Every invoice you issue to a customer needs to go through MyInvois. WauHub makes this simple.

Create Invoice

Create your invoice like you always do. Add the items, the SST, the customer details. Nothing changes here.

One-Click Submit

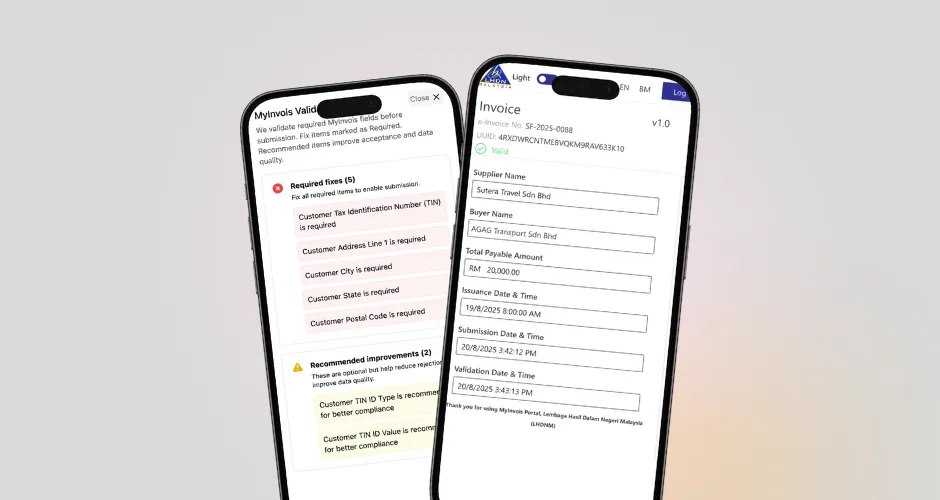

One button. WauHub checks everything is correct, formats it for LHDN, and sends it. You just wait a few seconds.

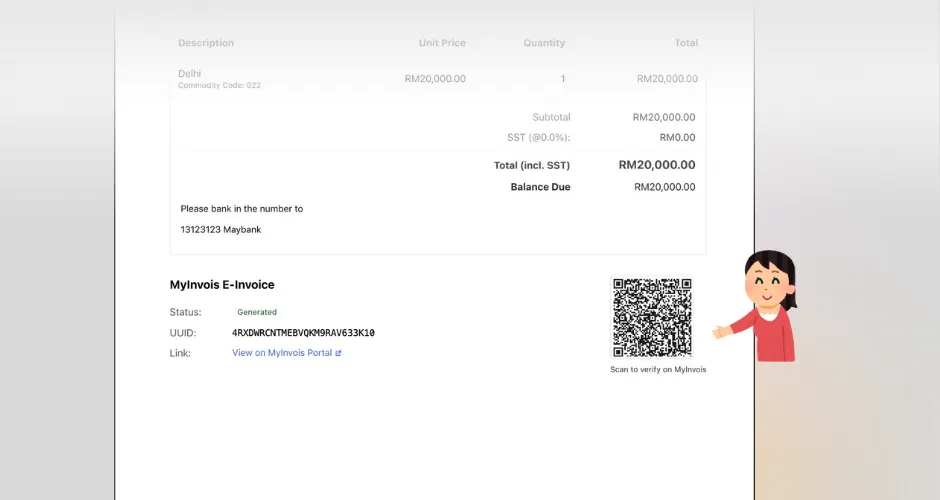

Get QR Code

Your invoice now has an official QR code from LHDN. Your customer can scan it to verify it's real. You're compliant.

What WauHub Handles For You

So you can focus on selling trips, not fighting with tax forms

Catches Errors First

Missing TIN? Wrong format? WauHub tells you before you submit, not after LHDN rejects it.

QR Code Included

Your customer gets a QR code they can scan. It links to LHDN's website to prove the invoice is legit.

TIN Validation

Customer gave you their TIN? WauHub checks with LHDN if it's valid before you submit. No surprises.

Credit & Debit Notes

Customer cancelled? Issue a credit note that links back to the original invoice. LHDN requires this.

See What Happened

Submitted? Accepted? Rejected? You'll see the status right in WauHub. No need to log into MyInvois.

USD Invoicing

Got overseas clients? Invoice them in USD. WauHub converts to MYR for LHDN. Export services are zero-rated.

Made for Travel Agencies

WauHub isn't just an e-invoice tool. It's a full system for travel agencies. Your bookings, passengers, and payments are already here. e-Invoice is just one more button.

e-Invoice Checklist

Need help getting set up? Our team can guide you through the process.

The Result

If you run a travel agency in Malaysia, e-Invoice can feel like one more thing on top of quotes, deposits, and last minute changes. This page is here to make LHDN e-Invoice simpler by guiding you through what MyInvois needs and helping you submit compliant e-Invoices with the right TIN details, classifications, and totals, so you stay ready without slowing down sales.

Frequently Asked Questions

Common questions about LHDN e-Invoice for travel agencies

When do I need to start using e-Invoice?

The timeline depends on your annual revenue. Travel agencies with RM1M+ must use e-Invoice by January 2026. Check LHDN's official timeline for your category.

Do I need to submit every invoice?

Yes, all B2B invoices must be submitted to MyInvois. B2C transactions have different rules — WauHub handles both scenarios appropriately.

What if my customer doesn't have a TIN?

For B2C customers without TIN, you can use the generic TIN provided by LHDN. WauHub handles this automatically based on customer type.

Can I invoice foreign clients?

Yes. WauHub supports USD invoicing for international B2B clients with automatic MYR conversion for LHDN submission. Export services are zero-rated for SST.

What about credit notes and refunds?

Credit notes and debit notes are fully supported and properly linked to original invoices as required by LHDN.

Get e-Invoice Ready Today

The deadline is coming. Get set up now so you're not scrambling later. We'll help you through the process.