Running a travel agency means juggling a hundred things at once - leads, bookings, suppliers, guides, and customers. The last thing you need is to also juggle between accounting software (Bukku, Xero, SQL) and a spreadsheet just to figure out if last month’s tour actually made money.

Most agency owners only find out they lost money on a tour after it is over. The group has returned, the suppliers have been paid, and only when you sit down to reconcile do you realise the margins were eaten up by hidden costs, card fees, or a supplier invoice you forgot to account for. By then, it is too late to do anything about it.

WauHub is built to change that. We want to be the complete system for tour operation and profit management, not just a booking tool, but the one place where your sales, costs, payments, and accounts all live together. So you can spot a loss before it happens, not after.

And we built it to be simple enough that even when your accountant is on leave, you as the owner can open it up, check the numbers, and know exactly where you stand. No accounting degree required.

Over the past month, we shipped several major features that bring this vision to life. This post breaks down what is new, why it matters, and how to start using these tools today.

The Problem We Were Solving

Travel agency owners kept telling us the same thing:

“I run a busy agency, but I have no idea if I am actually making money.”

Your booking system shows sales. Your bank account shows cash. But connecting those dots? Understanding true profitability? That required exporting data to Excel, wrestling with formulas, and hoping nothing broke.

For payments, the story was similar. You wanted to offer card payments for customer convenience, but the 3% gateway fee destroyed your margins on already-thin packages.

Something had to change.

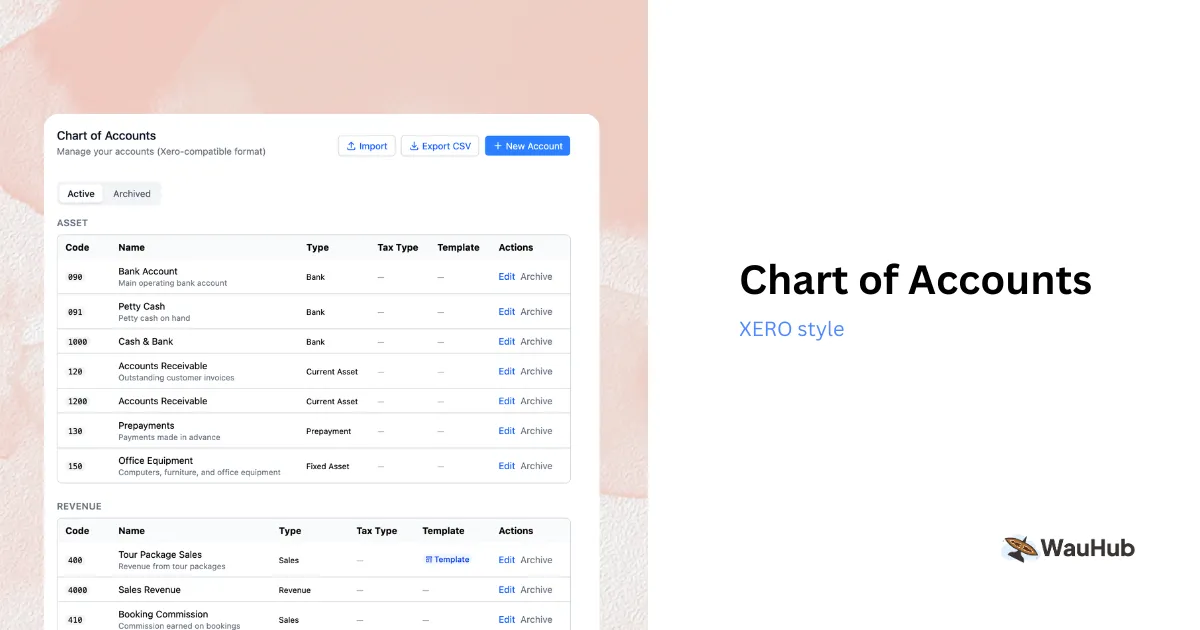

Feature #1: Chart of Accounts

What it is: A complete financial category system designed specifically for travel agencies.

Why it matters: Your business has unique transactions. Customer deposits held in trust. Commission income from suppliers. Multi-currency bookings. Refunds and cancellations. Generic accounting categories do not capture this complexity.

How it works: Every transaction in WauHub now automatically categorizes into the right account:

- Tour package sales go to “Revenue - Tour Packages”

- Commission from hotels goes to “Revenue - Commission Income”

- Supplier payments hit “Cost of Sales - Supplier Payments”

- Customer deposits land in “Liabilities - Customer Trust Deposits”

No manual entry. No guessing. Your books stay organized without you lifting a finger.

How to access: Navigate to Accounting > Chart of Accounts. Review the default categories. Add custom accounts if your agency has unique needs. That is it. Everything going forward automatically categorizes.

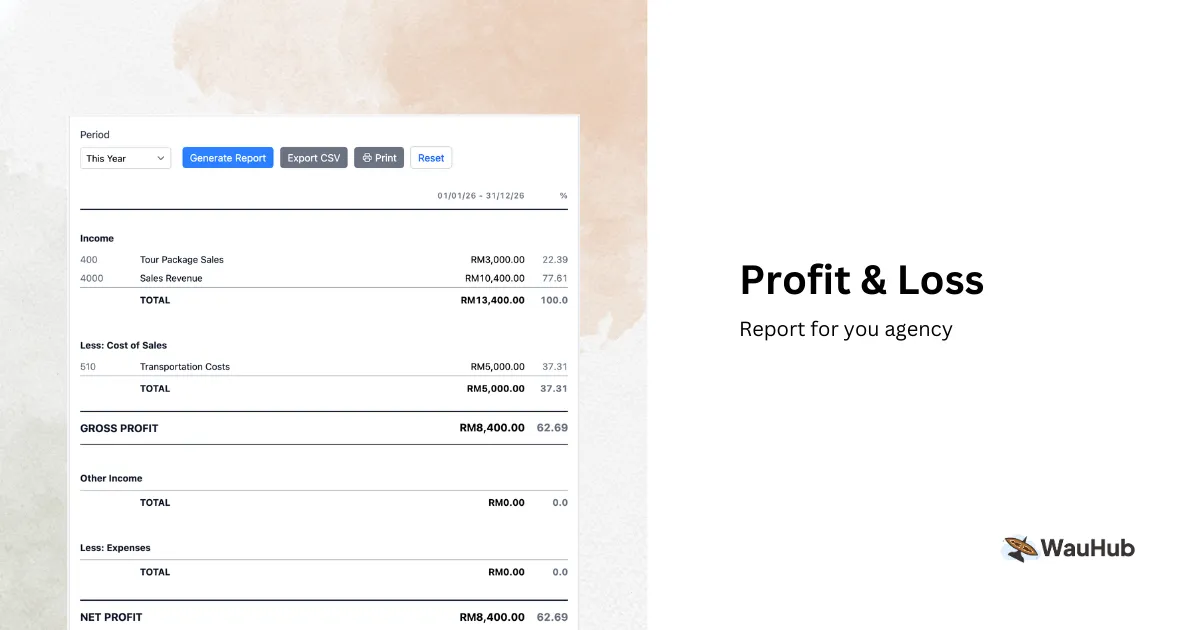

Feature #2: Profit & Loss Statement

What it is: A real-time report showing whether your agency made money this month, quarter, or year.

Why it matters: Sales revenue means nothing without knowing costs. You could book RM100,000 in tours and still lose money if supplier costs ran RM95,000 and expenses added another RM15,000.

How it works: WauHub automatically generates your P&L from categorized transactions:

Revenue: RM 100,000

Cost of Sales: (RM 75,000)

----------

Gross Profit: RM 25,000 (25% margin)

Operating Expenses:

Rent: (RM 3,500)

Salaries: (RM 12,000)

Marketing: (RM 4,500)

Utilities & Others: (RM 2,000)

----------

Total Expenses: (RM 22,000)

Net Profit: RM 3,000 (3% net margin)

See the difference between gross profit (25%) and net profit (3%)? That gap tells the real story. Your tours are profitable. Your overhead might be too high.

How to access: Go to Reports > Profit & Loss. Select your date range. Download PDF for your records or accountant.

Pro tip: Review this monthly. Not annually. Monthly reviews let you catch problems early while you can still fix them.

Feature #3: Balance Sheet

What it is: A snapshot of your agency’s financial position at any moment.

Why it matters: Profit and cash are different things. You might show profit on paper while struggling to pay bills because money is tied up in customer deposits or pending invoices.

The Balance Sheet shows:

- Assets: What you own (cash, equipment, money owed to you)

- Liabilities: What you owe (deposits held, bills unpaid, loans)

- Equity: Your net worth (assets minus liabilities)

How it works: WauHub tracks every transaction affecting your balance sheet:

ASSETS

Cash in Bank: RM 150,000

Accounts Receivable: RM 25,000

Equipment: RM 15,000

----------

Total Assets: RM 190,000

LIABILITIES

Customer Deposits: RM 80,000

Accounts Payable: RM 20,000

----------

Total Liabilities: RM 100,000

EQUITY

Owner's Equity: RM 90,000

----------

Total Liab. + Equity: RM 190,000

Notice that RM80,000 in customer deposits? That is not your money. It belongs to customers until you deliver their trips. The Balance Sheet keeps this visible so you do not accidentally spend money that is not yours.

How to access: Reports > Balance Sheet. Review monthly. Compare to previous periods to track growth.

Feature #4: Configurable Payment Methods

What it is: Choose exactly which payment options your customers see at checkout.

Why it matters: Not all payment methods suit all bookings. Small transactions might not justify card fees. Corporate customers might prefer invoice terms. International customers need card options.

How it works: You now control:

- Which methods appear (FPX, Cards, DuitNow QR, Manual Transfer)

- Minimum booking amounts for each method

- Default methods by customer type

- Descriptions customers see at checkout

How to access: Settings > Payment Methods. Toggle methods on/off. Set minimum amounts. Configure display order.

Feature #5: Enhanced Financial Dashboard

What it is: A unified view of your agency’s financial health.

Why it matters: Jumping between reports wastes time. You want one place to see cash position, outstanding invoices, upcoming expenses, and recent transactions.

How it works: The new dashboard displays:

- Current cash in all bank accounts

- Outstanding customer invoices (who owes you)

- Unpaid supplier bills (who you owe)

- Recent transaction activity

- Quick links to detailed reports

How to access: Dashboard > Financial Overview. Bookmark this page. Check it daily.

Real Impact: Numbers from Beta Users

Agencies testing these features before launch reported significant improvements:

Rasa Malaysia Tour (4 staff): https://rasamalaysiatour.com

“We discovered our group tour margins were actually negative. The P&L revealed we were losing RM200 per person on packages we thought were profitable. We raised prices immediately and conversions barely changed. Without the data, we would have kept bleeding money.”

Migration: Getting Your Historical Data

Existing WauHub users might wonder: “What about my old transactions?”

Good news: All historical bookings, invoices, and payments automatically categorize into the new Chart of Accounts. Your reports will show complete history from day one.

One-time setup:

- Review your Chart of Accounts

- Verify opening balances match your bank statements

- Run your first P&L and Balance Sheet reports

- Share with your accountant to confirm everything looks correct

Most agencies complete setup in under 30 minutes.

How to Get Started

This week:

- Review your Chart of Accounts settings

- Run your first P&L report

- Check your Balance Sheet opening balances

- Configure payment methods for your next booking

This month:

- Review P&L weekly to understand your true margins

- Experiment with card fee strategies on different booking types

- Share financial reports with your accountant for feedback

- Set up monthly financial review meetings

This quarter:

- Use data to make pricing decisions

- Identify and eliminate unprofitable services

- Build cash reserves based on Balance Sheet insights

- Plan growth investments backed by actual numbers

Final Thought: Knowledge Is Power

You cannot improve what you do not measure. These new features give you visibility into the financial engine of your agency.

No more guessing. No more hoping. Just clear numbers showing what works, what does not, and where to focus your energy.

That is the difference between running a business by feel and running it by facts.

Ready to see your true numbers?