Disclaimer: This article discusses common practices in the travel industry. It does not constitute legal or financial advice. Consult qualified professionals for guidance specific to your business.

You finally convinced the customer to book that RM15,000 Europe tour. They want to pay by credit card. Great, right?

Then you remember: credit card fees will cost you RM300. That is a significant chunk of your profit margin on the booking. Now you are stuck between accepting lower profit or awkwardly asking the customer to pay by bank transfer instead.

This scenario plays out daily for travel agencies. Payment convenience costs money. But who pays? You? The customer? What do other agencies actually do?

WauHub gives you flexibility in how you configure payment methods. This article explores how different agencies approach payment costs.

The Real Cost of Payment Convenience

Payment gateways charge fees for every transaction. WauHub partners with chip-in.asia to offer competitive rates. Here is what Malaysian travel agencies pay:

| Payment Method | Gateway Fee | Cost on RM10,000 Booking |

|---|---|---|

| FPX Online Banking (B2C) | RM1 flat | RM 1 |

| FPX Online Banking (B2B) | RM2 flat | RM 2 |

| Credit Card (Local) | 2.0% | RM 200 |

| Debit Card (Local) | 1.0% | RM 100 |

| DuitNow QR | 1.60% (Min: RM0.15, Max: RM1.50) | RM 1.50 |

| E-wallets | 1.40% | RM 140 |

| Foreign Credit/Debit Card | 3.0% | RM 300 |

| Buy Now, Pay Later (Atome) | 5.3% | RM 530 |

| Manual Bank Transfer | Free | RM 0 |

On a typical RM15,000 family tour package, these fees add up fast:

- Card payment (credit): RM300 in fees

- Card payment (debit): RM150 in fees

- FPX payment: RM1 in fees

- Manual transfer: RM0

If you run 20 bookings per month averaging RM10,000 each, card payments alone could cost you RM2,000 - RM4,000 monthly depending on card type. That is RM24,000 - RM48,000 per year. Real money.

Three Approaches Agencies Take

Different agencies handle payment fees differently. Here is what we observe in the market:

Approach #1: Absorb the Cost (Agency Pays)

Common among: Agencies with high-margin packages, premium positioning

Some agencies treat payment fees as a cost of doing business. Customer pays RM15,000. The agency receives RM14,800 after credit card fees. The RM200 disappears into operating costs.

Why agencies choose this:

- Customer sees one clean price

- No conversations about additional fees

- Matches customer expectations

Trade-offs:

- Eats directly into profit margins

- On low-margin packages, can significantly impact profitability

- Harder to track true payment costs

Typically seen when: Package margins above 20%, competing on service rather than price, or target market expects inclusive pricing.

Approach #2: Itemize or Quote Differently

Common among: Budget-focused agencies, B2B operators

Some agencies handle fees by presenting them separately or quoting card-inclusive prices upfront. For example, a customer might see:

Tour Package: RM15,000

Card Processing Fee: RM 300

-------------------------------

Total: RM15,300

Or the agency quotes RM15,300 upfront as the card payment price.

Why agencies consider this:

- Protects thin margins

- Transparent about costs

- Customers can choose cheaper payment methods

Trade-offs:

- Requires careful legal consideration (see section below)

- May affect customer perception

- Conversion rates can vary

Important: The legal framework around this varies. Some agencies use this primarily for B2B or corporate bookings where it is more commonly accepted.

Approach #3: Multiple Payment Tiers

Common among: Agencies serving diverse customer segments

Some agencies present different prices for different payment methods:

Pay by Bank Transfer (FPX): RM15,000

Pay by Credit Card: RM15,300

Pay by Debit Card: RM15,150

Pay by Manual Transfer: RM15,000

Customers choose based on their priorities. Those who value convenience may pay more. Those who want the best price choose lower-cost methods.

Why agencies consider this:

- Gives customers options

- May help recover costs on expensive payment methods

- Aligns pricing with payment costs

Trade-offs:

- More complexity to manage

- Requires clear communication

- Legal considerations apply (see below)

Understanding the Legal Landscape

The regulatory environment around payment surcharges in Malaysia is nuanced and evolving. Here is what businesses should understand:

Bank Negara Malaysia Guidance

Bank Negara Malaysia (BNM) and card schemes (Visa, Mastercard) have issued guidance that generally emphasizes:

- Transparency: Any additional charges should be clearly disclosed before payment commitment

- No undue discrimination: Fee structures should not unfairly target specific card brands

- Reasonable cost recovery: Any additional amounts should relate to actual costs incurred

The “Surcharge” vs “Different Pricing” Distinction

There is a subtle but important distinction in how payment costs are presented:

- Surcharging: Adding a fee on top of an advertised price at checkout

- Differential pricing: Quoting different prices for different payment methods upfront

Some businesses quote one price for bank transfers and a different price for cards from the start, rather than adding fees at checkout. This approach exists in the market, though its legal interpretation may vary.

Cost Recovery Calculation

When passing on payment costs, there is a mathematical consideration. If a gateway charges 2.0% and you want to receive exactly RM15,000:

-

Adding RM300 (2.0% of RM15,000) and charging RM15,300 means you receive: RM15,300 - 2.0% = RM14,994

-

To net exactly RM15,000 after a 2.0% fee, you would need to charge approximately RM15,306

Whether this distinction matters legally depends on interpretation of “actual cost recovery” versus “surcharging.”

Industry Practice

Different industries in Malaysia handle this differently:

- Airlines and hotels: Often display different prices for different payment methods

- Government services: Typically absorb payment fees or use specific approved methods

- Retail: Varies widely; some absorb, some differentiate pricing

Recommendations

Given the complexity:

- Consult a lawyer: Payment regulations change. Get professional advice.

- Document your approach: Keep records of how you calculate any payment-related amounts

- Be transparent: Whatever approach you take, communicate it clearly to customers

- Monitor regulatory updates: BNM and card scheme rules evolve

This section is for informational purposes only and does not constitute legal advice.

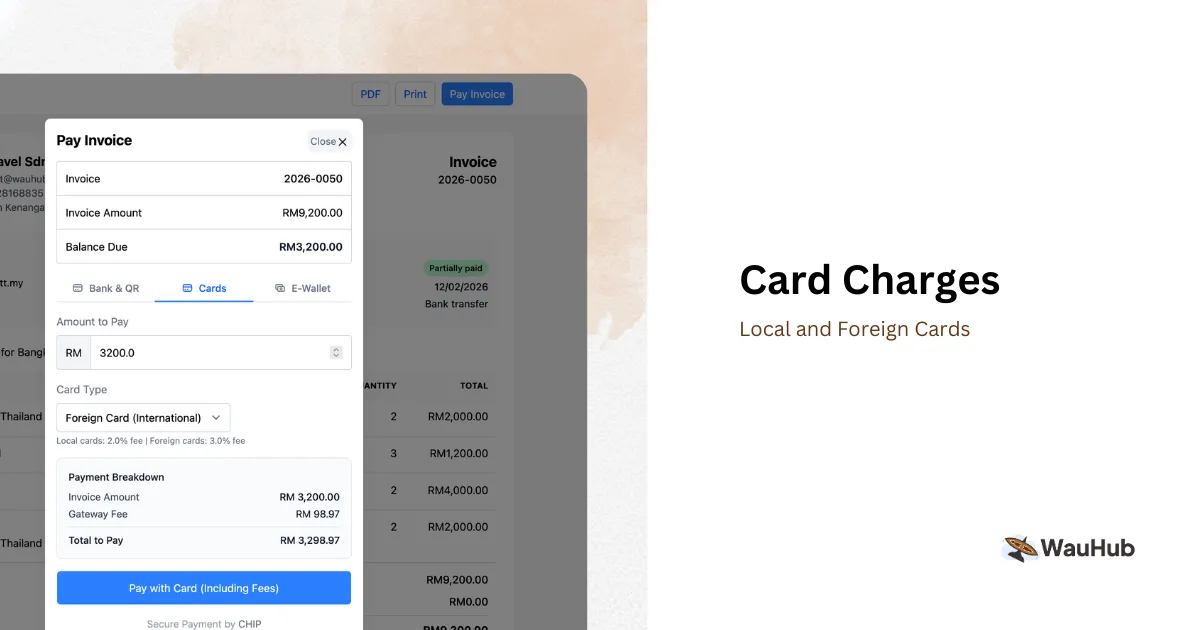

Configuring Payment Methods in WauHub

WauHub partners with chip-in.asia to provide competitive payment gateway rates. You can customize exactly which payment methods you offer:

Step 1: Choose Your Methods

Enable or disable each option:

- FPX Online Banking (all major Malaysian banks) — Settlement: next business day

- Credit/Debit Cards (Visa, Mastercard) — Settlement: every 2 business days

- DuitNow QR — Settlement: next business day

- E-wallets (Touch ‘n Go, GrabPay, Boost, ShopeePay) — Settlement: every 2 business days

- Buy Now, Pay Later (Atome) — Settlement: every Thursday of the following week

- Manual Bank Transfer — You manage manually

Step 2: Configure Your Pricing Approach

WauHub allows flexibility in how you structure payment options:

- Set single prices across all methods (absorb fees)

- Configure different prices for different payment methods

- Limit certain payment methods to specific booking thresholds

Consult your legal advisor on the appropriate structure for your business.

Step 3: Set Minimum Amounts

Some agencies only offer card payments for bookings above a threshold:

- Bookings under RM5,000: Bank transfer only

- Bookings over RM5,000: Card payment available

This prevents losing money on small transactions with high percentage fees.

Step 4: Configure by Customer Type

Some agencies configure different options for different situations:

- B2C leisure: May offer all methods with varied pricing

- B2B corporate: Often more accepting of differentiated pricing

- International customers: May prefer card-only for simplicity

Real Numbers: Impact on Your Business

Let us compare three scenarios for an agency doing RM200,000 monthly revenue:

| Scenario | Monthly Payment Fees | Annual Cost |

|---|---|---|

| All credit card payments (absorbed) | RM4,000 | RM48,000 |

| All FPX payments (absorbed) | RM20 | RM240 |

| Mix with differential pricing | RM20 | RM240 |

Potential difference: RM47,760 annually between absorbing all card fees versus using lower-cost methods.

This illustrates why understanding your payment costs matters for business planning.

Communication Approaches

How agencies communicate payment options varies. Here are some approaches observed in the market:

Inclusive pricing example:

“We accept payment via online banking (FPX), credit card, or bank transfer. All payment methods are available at no extra charge.”

Differentiated pricing example:

“Payment options:

- FPX Online Banking: RM15,000

- Manual Bank Transfer: RM15,000

- Credit Card: RM15,300

- Debit Card: RM15,150”

Incentive-based example:

“Pay RM15,000 via FPX or bank transfer. Card payments accepted at RM15,300. All options secure your booking immediately.”

Note: How you word this depends on your legal advice and business model.

The Psychology of Payment Choice

Why do customers choose one payment method over another?

Card payers value:

- Convenience (one click)

- Rewards points/cashback

- Consumer protection

- Credit (pay later)

FPX payers value:

- Lower cost

- Direct from bank (familiar)

- No credit card debt

- Simpler for large amounts

When you understand these motivations, you can present options that appeal to both types.

Evaluating Your Payment Strategy

Consider this framework for assessing your approach:

Step 1: Calculate your average booking value and profit margin

Step 2: Understand the actual costs of each payment method you offer

Step 3: Research how other agencies in your segment handle payment costs

Step 4: Consult a lawyer on the current regulatory framework

Step 5: Configure WauHub to match your chosen approach

Step 6: Review monthly data to understand customer payment preferences

Step 7: Adjust based on what works for your business and customers

Finding Your Approach

Payment methods affect both customer experience and business profitability. Different agencies find different approaches work for them:

- Some absorb all costs and build them into base pricing

- Some present different prices for different payment methods

- Some limit payment options based on booking size or customer type

The right approach depends on your margins, customer base, and risk tolerance. The key is making an informed decision with proper legal guidance.

Want to explore your options?

Understanding your payment costs is the first step toward managing them effectively.