Your accountant just asked for your Balance Sheet. You stared at them blankly. Then they asked for your Profit & Loss statement. You opened a messy Excel folder and hoped for the best.

Sound familiar? For most travel agency owners, accounting feels like a foreign language. You are great at planning trips, managing customers, and closing sales. But financial statements? That is what you pay accountants for, right?

Here is the problem. Without understanding your own numbers, you are flying blind. You might feel busy, but are you actually profitable? Which destinations make you money? Which ones drain your cash?

Good news: accounting does not have to be complicated. WauHub now includes three essential accounting features designed specifically for travel agencies. No accounting degree required.

Why Travel Agency Accounting Is Different

Standard accounting software treats every business the same. But travel agencies have unique needs:

- Customer deposits held in trust (not your revenue yet)

- Supplier payments often larger than your margin

- Multi-currency transactions (USD, EUR, JPY, THB)

- Commission income from hotels and airlines

- Cancellation and refund handling

Your Chart of Accounts needs to reflect this reality. Generic categories like “Sales” and “Expenses” do not capture the full picture.

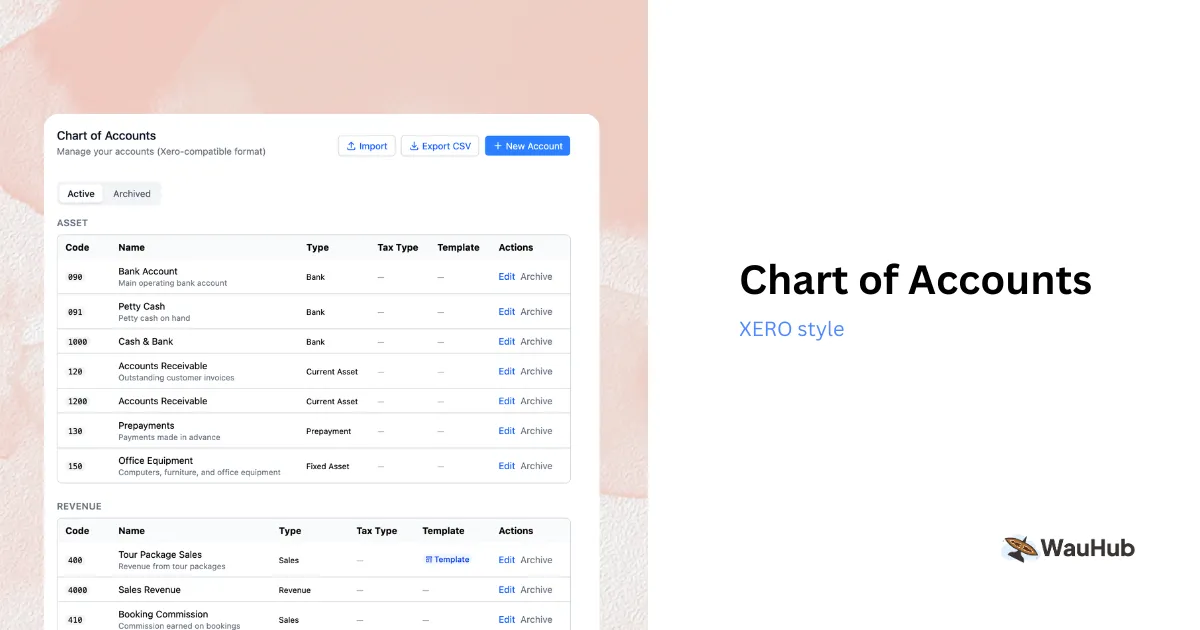

Chart of Accounts: Your Financial Map

Think of your Chart of Accounts as the filing system for every ringgit that flows through your business. It organizes transactions into meaningful categories so you can actually understand where money comes from and where it goes.

What WauHub includes:

| Category | Examples for Travel Agencies |

|---|---|

| Revenue | Tour packages, Commission income, Service fees, Visa processing |

| Cost of Sales | Supplier payments, Hotel bookings, Flight tickets, Land arrangements |

| Operating Expenses | Rent, Utilities, Marketing, Software subscriptions |

| Assets | Bank accounts, Fixed deposits, Equipment, Office furniture |

| Liabilities | Customer deposits (trust), Loans, Credit card balances |

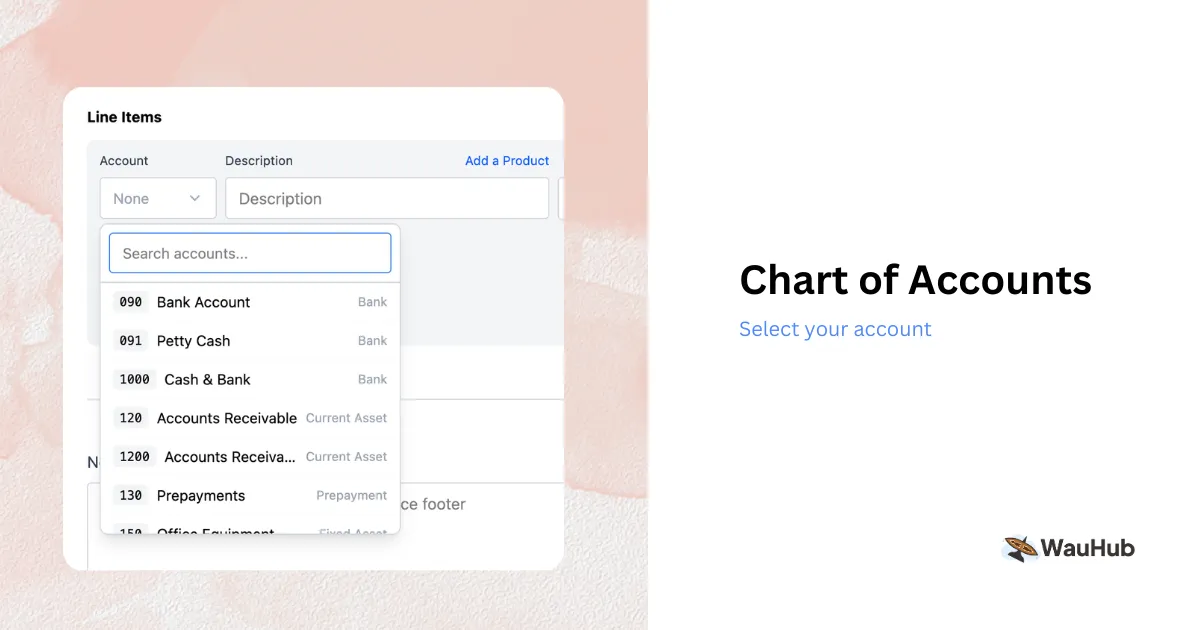

The magic happens automatically. When you record a booking in WauHub, the system knows where to categorize it. Create an invoice? It hits the right revenue account. Pay a hotel supplier? It records the cost of sale. Receive a customer deposit? It goes to liabilities (because it is not yours until the trip completes).

No double entry. No manual categorization. No mistakes.

Xero-Compatible and Ready to Use

WauHub’s Chart of Accounts works seamlessly with Xero:

Load Default Codes: Start instantly with a complete, travel-agency-specific Chart of Accounts pre-configured with standard codes for revenue, costs, and expenses.

Import from Xero: Already have your accounts set up in Xero? Export your Chart of Accounts from Xero and import it directly into WauHub. All your codes, names, and account types transfer automatically.

Export to Xero: Need to share your Chart of Accounts with your accountant or migrate to Xero? Export in Xero-compatible CSV format anytime.

This means your accountant can work in Xero while you manage bookings in WauHub, with both systems speaking the same accounting language.

Profit & Loss: Are You Actually Making Money?

Your Profit & Loss statement (also called Income Statement) answers the most important question: Did we make money this month?

Here is what agency owners discover when they actually look at their P&L:

Surprise #1: Your biggest tour package has the smallest margin.

That Japan Cherry Blossom tour everyone loves? After hotel costs, flight allocations, and guide fees, you might only keep 8% margin. Meanwhile, your Bali honeymoon package quietly delivers 25%.

Surprise #2: Your “busy” months are not your profitable months.

December feels crazy. Non-stop enquiries, bookings flying in. But check the P&L and January actually performed better. Why? December had heavy marketing spend and discounts. January customers paid full price.

Surprise #3: Small expenses add up to big numbers.

That RM150 monthly here, RM300 there for software tools? Over a year, it is RM10,000. The P&L reveals it clearly.

How WauHub P&L Works

Your Profit & Loss updates in real-time:

REVENUE

Tour Package Sales RM 85,000

Commission Income RM 12,500

Service Fees RM 4,200

----------

Total Revenue RM 101,700

COST OF SALES

Supplier Payments RM 62,000

Commission Paid RM 8,500

----------

Gross Profit RM 31,200 (30.7% margin)

OPERATING EXPENSES

Rent RM 3,500

Salaries RM 12,000

Marketing RM 5,200

Utilities & Others RM 2,100

----------

Total Operating Expenses RM 22,800

NET PROFIT RM 8,400 (8.3% net margin)

See the difference between gross profit (30.7%) and net profit (8.3%)? That gap tells a story. Maybe marketing spend is too high. Maybe rent is eating your margin. The numbers guide your decisions.

Balance Sheet: What Do You Actually Own?

If P&L is a movie, Balance Sheet is a photograph. It shows your financial position at a specific moment in time.

What you own (Assets):

- Cash in bank accounts

- Money customers owe you (accounts receivable)

- Equipment and assets

What you owe (Liabilities):

- Money held for customers (trust deposits)

- Outstanding bills to suppliers

- Loans and credit cards

Your net worth (Equity):

- Assets minus liabilities equals what the business is worth to you

The Travel Agency Cash Trap

Here is a scenario that kills agencies:

- Customer pays RM50,000 deposit for a group tour

- You use that money to pay suppliers early (to get discounts)

- Trip gets cancelled

- You must refund the customer

- But you already spent the money

Your Balance Sheet would have flagged this immediately. That RM50,000 sits in liabilities, not equity. It is not your money. Seeing this clearly prevents disasters.

Real Numbers from Real Agencies

We asked a Malaysian travel agency to share what they learned after using proper accounting reports:

Malaysia Taste Food Tour (Kuala Lumpur, 5 staff) https://malaysiataste.com

“Monthly P&L reviews became our management meeting ritual. We review which sales channels deliver the best margins. Instagram ads look cheap, but when we factor in time spent on enquiries, they cost more than referrals. Data changed how we allocate marketing budget.”

Getting Started: Your First Month

You do not need to become an accountant. You just need to look at three reports monthly:

Week 1: Check your Balance Sheet

- How much cash do you actually have?

- Are customer deposits properly separated?

- Any surprises in what you owe?

Week 2: Review Profit & Loss

- Did you make money last month?

- Which services delivered the best margins?

- Where is money leaking?

Week 3: Examine trends

- Compare to last month

- Compare to same month last year

- Is the business growing sustainably?

Week 4: Make one decision

- Adjust pricing on low-margin packages

- Cut unnecessary expenses

- Double down on profitable services

Built for Malaysian Travel Agencies

WauHub accounting features understand your business:

- Automatic categorization of bookings, invoices, and payments

- Trust accounting for customer deposits

- Multi-currency support for international bookings

- LHDN-ready reports for tax season

- E-Invoice integration so revenue tracking stays accurate

No manual data entry. No importing from other systems. Your bookings flow directly into your financial reports.

From Confusion to Clarity

You do not need to love accounting. But you do need to understand your numbers. Chart of Accounts organizes your transactions. Profit & Loss shows if you are winning. Balance Sheet reveals your true financial position.

Together, they replace gut feeling with facts. Instead of hoping you are profitable, you know. Instead of guessing which tours work, you see the margins clearly.

Ready to understand your travel agency finances?

Your accountant will thank you. Your future self will too.