You sent the bank account details three days ago. The customer said they would pay “tonight.” Now they are not replying to your messages. Another booking slips away.

If you are still collecting deposits via manual bank transfer, this scenario plays out weekly. Malaysian travel agencies lose 12% of confirmed bookings to payment delays. Not because customers changed their minds. Because the payment process was too slow and complicated.

Payment links change everything. Agencies using them collect deposits in 2 to 4 hours instead of 5 days. Here is how they work and why customers actually prefer them.

Why Traditional Bank Transfers Kill Bookings

Manual bank transfers worked fine ten years ago. Today, they create too much friction.

The customer experience:

- Opens banking app

- Adds you as a new payee (hope they spell your name right)

- Enters the amount manually

- Takes a screenshot

- Sends it to you

- Waits for you to confirm

Six steps. Six chances to get distracted, forget, or change their mind.

Your experience:

- Checking bank apps multiple times a day

- Matching mysterious transfers to bookings (“Who sent RM2,500?”)

- Sending awkward reminder messages

- Watching hot leads go cold

- Issue receipt manually

The numbers tell the story. Our data shows agencies using manual transfers average 5.2 days to collect deposits. During that window, 12% of bookings evaporate.

What Payment Links Actually Do

Payment links turn that 6-step process into 3 clicks.

Here is what happens (WauHub will issue receipt automatically after payment completed):

- You create an invoice and click “Send Payment Link”

- Customer receives a WhatsApp message with a secure link

- They click, review the invoice, and pay via FPX, card, or DuitNow QR

- You get instant notification. Invoice auto-updates. Done.

Average time from quote to deposit: 2-4 hours.

Not days. Hours.

The momentum stays alive. The customer was excited about the trip when they opened your message. Now they can act on that excitement immediately.

Real Results from Malaysian Travel Agencies

We tracked 47 travel agencies before and after switching to payment links. The results:

| Metric | Manual Transfer | Payment Links |

|---|---|---|

| Average deposit collection | 5.2 days | 4.3 hours |

| Payment reminders per booking | 3.4 | 0.2 |

| Daily admin time | 2 hours | 15 minutes |

| Bookings lost to delays | 12% | 3% |

That last number matters most. You are not just saving time. You are saving bookings.

How Payment Links Work in Practice

Step 1: Create the Invoice

When the customer confirms, generate an invoice with:

- Trip details and inclusions

- Deposit amount and balance due date

- Your business details (LHDN-compliant for e-Invoice)

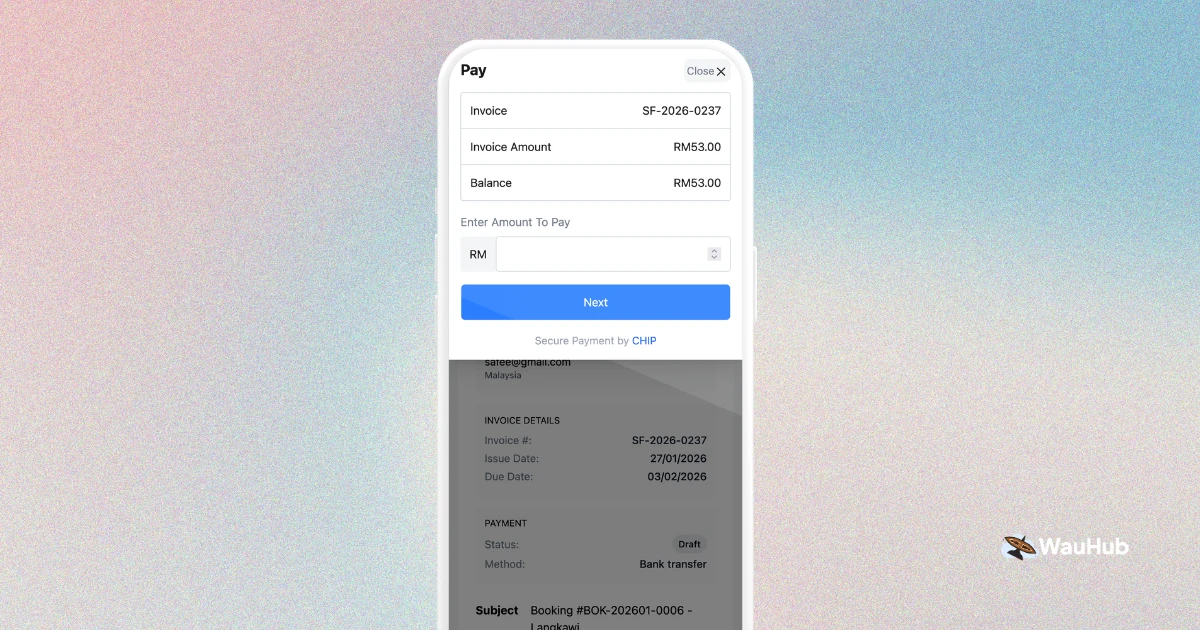

Step 2: Generate the Payment Link

One click creates a secure payment page featuring:

- Your logo and branding

- Complete invoice breakdown

- Multiple payment options (FPX, cards, DuitNow QR)

Step 3: Send via WhatsApp

Paste the link into your chat:

“Hi Sarah! Here is your invoice for the Japan Cherry Blossom Tour. You can review the details and pay securely here: [link]. Thanks for choosing us!”

Step 4: Customer Pays

They click on their phone. See a professional invoice page. Choose their preferred payment method. Complete payment in under 2 minutes.

No account numbers to copy. No screenshots. No waiting.

Step 5: Automatic Reconciliation

The moment payment clears:

- You receive WhatsApp and email notification

- Invoice status updates to “Paid”

- Receipt generates automatically

- E-Invoice submits to LHDN (if applicable)

Your books stay organized without manual work.

The Psychology Behind Instant Payments

Why do payment links convert so much better? Three reasons:

1. Strike While the Iron is Hot

Travel bookings are emotional decisions. The customer is excited NOW. Give them a way to commit NOW. Every hour of delay is a chance for doubt to creep in.

2. Reduce Cognitive Load

Manual transfers require planning and effort. Payment links require one tap. The easier you make it, the more people do it.

3. Build Trust Through Professionalism

A branded payment page looks legitimate. It signals “real business” not “someone with a WhatsApp account.” That matters when customers are deciding who to trust with their holiday.

Payment Options Customers Actually Want

Not everyone wants to pay the same way. Good payment links offer choices:

- FPX Online Banking: Direct bank transfer for customers who prefer it

- Credit/Debit Cards: For installment options or rewards points

- DuitNow QR: Scan and pay for mobile-first users

- Manual Transfer: Still available for traditional customers

Let them choose. Most will pick the fastest option.

E-Invoice Integration (LHDN MyInvois)

With mandatory e-Invoice for businesses above RM1 million revenue from January 2026, payment links integrate directly:

- Customer pays via link

- System marks invoice paid

- E-Invoice auto-submits to LHDN

- QR code and validation ID generated

- Receipt sent to customer

No manual steps. No compliance headaches.

Setup and Costs

What you need:

- Business bank account

- Payment gateway account (we guide you through setup)

- Travel management software with payment link feature

Setup time: Most agencies collect their first payment within 24-48 hours.

Transaction fees: Payment gateways charge 1-2% per transaction. Consider the savings:

- Time saved: 2 hours daily at RM50/hour = RM100/day

- Bookings recovered: 9% more conversions

- Cash flow improvement: Money in your account days earlier

The math works in your favor.

Your First Payment Link: A Challenge

Try this today:

- Create one invoice for a real pending booking

- Generate and send the payment link via WhatsApp

- Watch what happens

Most agencies are surprised. Customers actually prefer this method. It is easier for them too.

Why WauHub Payment Links

- All Major Malaysian Banks: FPX coverage for every customer

- Cards & DuitNow QR: Multiple payment options

- Automatic Reconciliation: No manual matching needed

- E-Invoice Ready: LHDN MyInvois integration built-in

- Smart Reminders: Set and forget follow-ups

Setup takes less than a day. Start collecting payments faster this week.